Although CTRM and ETRM systems have many features in common, and are often referred to as E/CTRM, each system is designed to solve different problems, and as such, can sometimes leave businesses without all the functionality they need to truly get the most out of their technology investment.

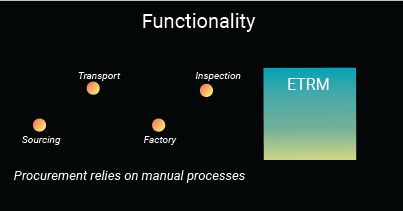

The features and functionality of an E/CTRM system vary depending on software providers, but in general, ETRM focuses on energy trading, with some functionality for the physical commodities used to generate power, whereas Commodity Trading and Risk Management systems focus on physical commodity management. In the past, organisations have been forced to choose which of these two technologies best suits their needs, for example selecting an ETRM that allows better control over electricity contracts but that means less efficient manual processes when procuring fuels.

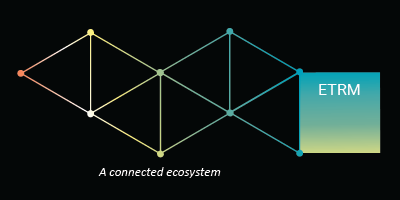

This is why Gen10 have taken an app-based approach. Our cloud-based commodity management apps allow you to leverage your existing technology to drive better results by complementing your ETRM with apps to solve the problems this system is not currently addressing. For energy companies in particular, the ETRM can often be complemented by supply chain management and contract management apps to improve the often-lengthy processes that come before a contract is entered into the ETRM.

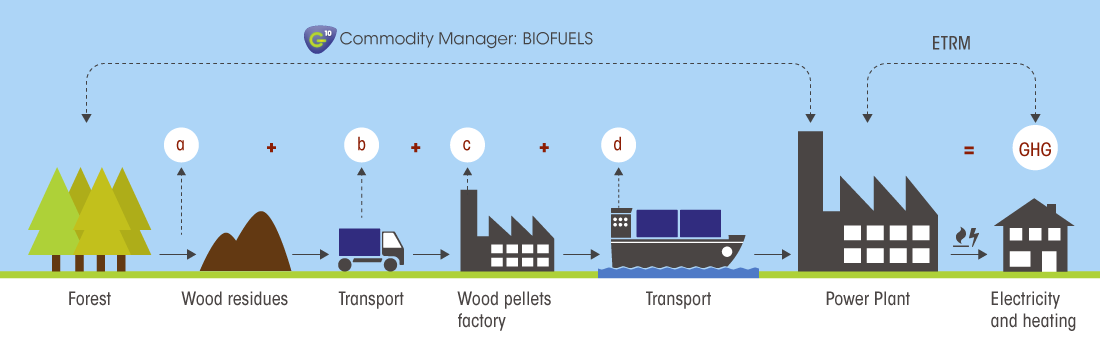

An example from the biomass supply chain

In the below example we assume a utility company is using an ETRM that meets their needs for power but its biomass procurement, supply chain and traceability management features are slowing down processes.

Contract.Manager

The company decide to implement contract management technology to solve their most urgent need before committing to a large-scale project. Legal, Commercial, Financial and Sustainability departments are no longer working in silos of information and offline cumbersome processes. They are brought together to ensure responsible procurement with all the necessary checks and balances in place. They create pre-approved document templates that remove the need for Legal and Sustainability teams to read each individual contract and set up automated processing workflows to progress contracts through their existing processes.

They gain the ability to manage contracts from anywhere on almost any device, have more control over contracts, special clauses and approvals, and create a complete audit trail. As well as generating contracts from within the system, they can now automatically feed their positions into their ETRM whilst reducing paperwork and workloads.

Deal.Capture

After a month, Contract.Manager is live and being used across the business. The company now decide to improve their procurement process and gain better trade visibility across the organisation. They use an offer/bid app that allows traders to close and capture deals quickly across desktop, mobile and tablet devices.

They are able to streamline high-volume transactions, track offer-bid spreads and perform deep analysis of company-wide activity as it happens. They connect this app to Contract.Manager so that the contract management process automatically begins as soon as a price is agreed, with no need to re-enter any data.

Aud.IT

With better control over their internal processes, they are now in a position to proactively assure sustainability across their supply chain. They introduce a mobile and web app that allows inspectors or partners to visit sites, complete due diligence surveys and upload supporting evidence, including the device’s GPS co-ordinates if needed. They create a clear audit trail across the supply chain by integrating the technology with their other Gen10 apps and ETRM for ongoing KYC.

These apps work within the business’ existing processes and with the ETRM to help speed up every trade, reduce the errors and omissions associated with manual processing and add value to the organisation’s existing technology investment.

Want to read more?

Subscribe now for monthly updates

By submitting your details you agree that we can store your data and communicate with you. You can opt out of these communications at any time. Read all in our Privacy Policy.