For too many years, CTRM systems have been seen by traders as more of an administrative task that complicates workloads than as a tool that can speed up processes, manage risk and ultimately improve trading margins.

This is largely because of the continued use of legacy CTRM systems that do not have the functionality and flexibility of modern CTRM and commodity management systems. These old CTRMs, that in some cases have been in use for decades, were designed to capture information about trading activity for use in risk management. The main interaction traders therefore had with these platforms was as a source of administrative work.

In the last few years, there has been a growing awareness amongst commodity traders that technology can do more to support their work than these legacy systems allow. A growing number of commodity traders are now discovering that modern CTRM technology can do far more for trading teams than the legacy systems whose limitations they are used to.

A good modern CTRM should be available in the Cloud. It should also allow all members of the organisation to manage their work within the system, efficiently processing and automating contracts to reduce administration and improve margins. And it provides instant access to the data traders need in real-time as they need it.

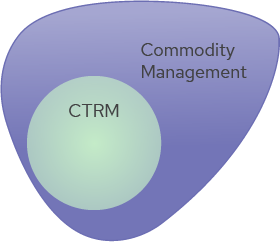

Gen10 technology offers functionality beyond even this modern class of CTRM, in a category known as commodity management software. This technology takes the system and its benefits to a wider range of internal job roles, including your operations and logistics teams. Bringing the entire business together in one platform has benefits for traders as well as these teams by providing unprecedented position visibility; giving you information on the entire business as things change throughout the day.

CTRM is only part of a commodity management system’s functionality

How CommOS helps traders become more efficient

Deal Capture

Capture all the details of physicals contracts just once and use them to power all automated calculations and documents, with no need to retype or copy information. The intuitive interface makes entering data quick and easy, and is developed specially for different commodities so that it allows you to capture all the relevant information, without showing irrelevant options.

And the quick deal capture option for futures trades is even simpler. Once captured, futures trades can be easily matched to a physical contract, showing any gaps in hedging, market value, P&L, commission and more, with any currency conversions automatically carried out for you.

Automated workflows

There are many arguments for moving your trading processes to a modern commodity management system, from the reporting delays common in older systems and Excel spreadsheets to the risk of errors when calculating or copying information manually. However, possibly the most convincing argument for working within the system is that it is fundamentally less work.

Gen10’s unique Workflow.Engine automates a wide range of your processes for handling and trading commodities. Once a deal has been captured, the contract and any other documents such as requests for release or invoices can all be generated automatically with a click. There is no longer any need to copy information. And when the document is ready for progression, traders simply click a button to send it on to the relevant department or counterparty, with controls meaning it follows your process at all stages.

Automated workflows passing tasks to operations teams mean that they have all the information relating to the contract instantly, can see a complete history of any changes and can manage the logistics without needing to consult the trader in normal circumstances. And workflows between finance, legal and other middle-office teams and traders mean faster approvals, create opportunities for pre-approvals and give traders more information and therefore more freedom whilst still protecting the business from risk.

Pricing Formulae

Workflows are not the only automation to make life easier for traders. The Pricing.Engine automatically calculates valuations for all your documents and reports based on the information traders input and your own pricing formulae. For commodities such as concentrates, this can mean calculating pricing for multiple assays in one contract instantly.

Add tiered pricing to a contract or add a discount based on locations and other variables, as well as creating your own pricing formulae. Because the pricing can be instantly updated as system information changes, what-if analysis is also instant, allowing traders greater optionality and the ability to quickly experiment with different models to create the best outcomes.

Traders can also select which exchange they wish to price against, or set up composite curves which are stored in the system for use whenever they are needed, and again all pricing is automatically calculated based on this composite index, giving the ability for traders to be incredibly creative in their pricing strategies with ease and control.

The Pricing.Engine also allows you to work in multiple currencies and units of measure, automatically converting data and giving you a clear view in your preferred format. All the optionality present in these pricing calculations is also available when adding FX and interest to contracts, giving traders the flexibility they need to create even the most complex pricing strategies.

Position visibility

The above flexibility does not help traders if they do not have the position visibility to make the most of it. With all teams taking advantage of CommOS to make their work lives easier and faster, real-time position visibility is the norm. As soon as counterparties are approved, they are listed in the CRM, and if documents need to be added or updated, they also show immediately for all who need to be aware of them.

All who need it can also see all physical goods’ global locations, assays and grades, as well as whether they are free to be allocated, whether the contract is hedged and more – and know as soon as things change. This level of position visibility allows each team to complete their part of the contract efficiently and allows both traders and operations teams to create the most profitable strategies.

Assay management

On top of the assay pricing above, the logistics features that manage assays and inspections can reduce administration and ensure contracts are resolved faster when things change. Logistics workflows allow you to build inspections into your digital processes and update records based on their outcomes, whether that’s changing the moisture content of cotton or updating several assays in a metal concentrate. These updates can be made and invoices issued or re-issued, with no need to make changes to the original contract, meaning faster, simpler processing.

Risk management

Real-time position visibility also means real-time risk management. Risk reports are an integrated part of CommOS so there is no need for traders to re-enter information or manually create reports – the reports take care of themselves whilst you do the work that creates value for the business.

This also means real-time reconciliation, with no need to wait for month-end or daily reports. With CommOS you can check your hedging instruments and market exposure throughout the day, making adjustments before losses are incurred. Traders also benefit from seeing the P&L for each trade as soon as contracts are matched and system-generated P&L Explained reports.

Finance and legal teams add pre-approval limits, so that traders can check credit lines and proceed without waiting for other teams, safe in the knowledge that controls prevent breaches of your risk policies. Improve access to funding by creating documents and bank releases in seconds, finalising payments faster and providing instant credit line information across the business.

Commodity management systems empower traders

Modern CTRM and commodity management systems are a completely different class of technology compared to the admin-intensive after the fact recording systems of times gone by. Rather than making more work for traders, CommOS reduces and automates manual tasks so that traders have more time to focus on the things that really matter.

Incorporating other teams through commodity management capabilities gives traders the information they need to make more informed decisions faster and with more autonomy. Ultimately, a good commodity management system configured to your workflows means that traders save time, are more effective and can create more profitable opportunities.