Demand for biomass energy generation continues to rise sharply. The use of bioenergy for electricity grew by 98% between 2008 and 2015, and the market for wood pellets in particular is expected to grow to $6150 million by 2024, up from $4120 in 2019. This provides many opportunities for biomass and energy traders, but it does also mean that the challenges the industry faces are changing as well. From increasing regulation to new players and changing market mechanisms, biomass companies need to be prepared to meet these new challenges as well as capitalise on new opportunities.

Organisations with poor visibility of their position, counterparty and sustainability data are currently missing out on a major opportunity to better navigate this changing landscape. Improving data visibility across the business can power significant improvements in risk management, efficiency and profitability, and should be an option for all organisations as it is based on simply improving access to the information that you already own.

Biomass traders need to be prepared to act on a wide range of data

Traceability and risk in the biomass supply chain

The market is driven by regulation; on top of strict limits on lifecycle CO2 emissions to qualify for subsidies, there are a range of sustainability certificates including Green Gold Label and Sustainable Biomass Partnership standards, and of course products must meet the ISO standards for solid biofuels if they are to be traded.

Risk management therefore begins with data visibility across the supply chain. Supplier audits, sustainability certificate management and ongoing Know Your Counterparty (KYC) data updates (both up- and downstream) are essential for effective risk management. But in the current regulatory environment, you also need to be able to demonstrate that your processes are robust and your data is accurate.

Data visibility plays a crucial role in this verification. For example, if you do not manage your counterparties’ sustainability certificates in one easily accessible single source of truth, there is the risk of data being copied incorrectly, expiration dates being missed, and significant delays between one person at your organisation receiving mandatory documents and these being available to others. These delays and risks could mean traders are missing opportunities to make profitable transactions, or worse, are inadvertently dealing with non-compliant partners.

Improving profitability through traceability

Faster, broader access to traceability data not only protects your organisation from the above risks but can also improve profitability. Faster onboarding means trading teams can begin working with counterparties sooner and can therefore increase their trading volume with the counterparty. This can also lead to better customer service and a better chance of retaining counterparties.

Sharing KYC data from one single source of truth also accelerates each trade, meaning faster asset turnover and therefore profitability. For example, if you can provide traders with real-time counterparty credit line utilisation data, they can check whether a deal is appropriate for a given counterparty and spend less time on deals that will not be approved by finance teams further down the line. The best commodity management technology such as Gen10’s CommOS also gives you the option of creating pre-approvals so that traders instantly have a clear-cut understanding of whether a trade is approved, without finance teams being involved in each individual instance.

Reducing operational risk in biomass organisations

Data visibility extends beyond counterparty data and includes keeping a clear record of the data your organisation creates. CommOS includes a complete location history of physical goods and provides an audit trail of every action for each trade. It can also help you ensure you provide the data visibility your customers need, for example by creating alerts or preventing shipments if mandatory traceability documents are not provided.

Again, this visibility can provide advantages far beyond traceability and compliance. For example, CommOS allows you to efficiently share information between different systems, with no need to re-enter data once it has been input anywhere else; including the ability to automatically generate contracts, shipment documents, invoices and more.

Position visibility and profitability

Position visibility gives traders and operators the optionality and agility they need to take advantage of every opportunity as it arises.

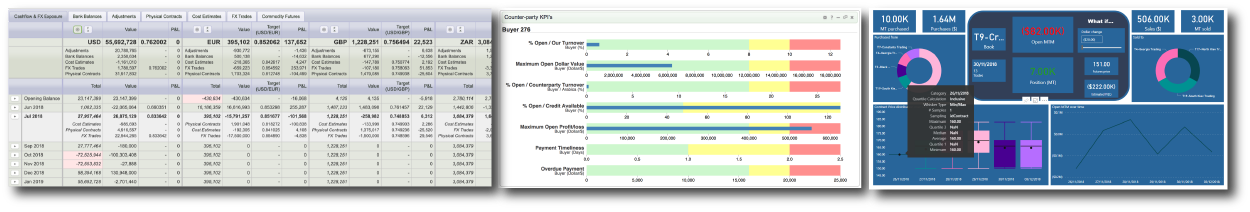

Through a combination of custom dashboards and integrations with external reporting software, CommOS gives traders the information they need about your positions, counterparties and markets. You can also perform what-if analysis, check your MTM instantly and view unrealised P&L as soon as contracts are allocated – without waiting for an end of day report.

Amongst other benefits, operators can instantly see any stock that has not been allocated to a contract and use maps to view global position data in real-time so that they can quickly create the highest-value stock allocations and optimise shipping. This data visibility combines with the automated data sharing to ensure the operations team can act with greater efficiency, fewer errors and create more value for your business.

Improving data visibility within a biomass organisation improves outcomes across traceability, trading, operations, finance and other teams. Data sharing creates greater efficiencies, reduces the risk of errors and omissions and allows traders to respond to changing conditions instantly, whilst reducing the impact on other teams. Biomass organisations looking to improve risk management, traceability and profitability can’t afford to overlook the importance of data visibility.