Metals and the energy transition – can your CTRM handle it?

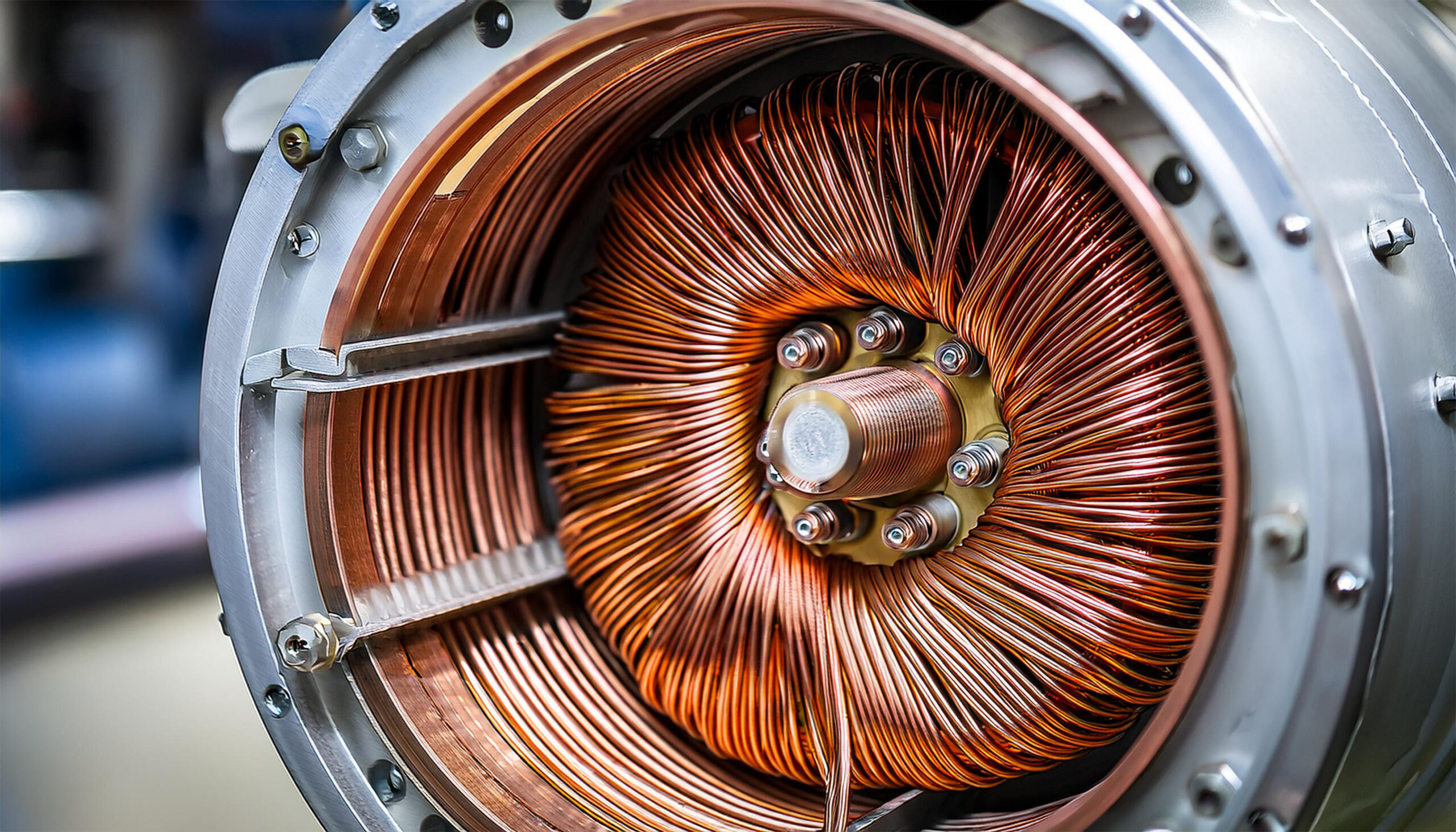

The energy transition may not be making as many headlines right now as it has in the past, but it has quietly been continuing throughout 2025; with momentum particularly strong in low-emissions power, transportation electrification, and critical minerals supply. Metals and mining are at the heart of all these initiatives, from copper’s role in electric vehicles and grid infrastructure, to the growing demand for battery metals and the rare earth minerals that go into electric vehicles and wind turbines. Until the mid-2010s the energy sector represented a small part of the total demand for most minerals, but energy is expected to account for over 40% of demand for copper, 60-70% for nickel and cobalt, and almost 90% for lithium over the next two decades.

This anticipated growth in demand will have a significant impact on metals traders, with anticipated price increases, potential supply bottlenecks, and new sourcing geographies. In fact, there is some doubt as to where all of these metals will come from and hence, we may see lots of price volatility. These factors will also increase supply chain complexity and geopolitical risk, and we are already seeing increased competition from large new market entrants responding to these changing market conditions.

And related to the energy transition, metals traders are under increasing pressure to manage the carbon footprint of their own operations. Across geographies, ESG compliance, carbon reporting, and traceability requirements are becoming increasing enshrined in legislation, expected by clients, and encouraged by exchanges.

Energy transition challenges for metals traders

As mentioned above, the energy transition is already causing market uncertainty, with significant price volatility expected over the coming years. This is attracting larger commodities firms back into the metals space, and some oil traders are also building out their metals desk as a method of future-proofing.

The growing demand has not necessarily led to increased investment in greenfield mines, particularly from Western companies. This means that sourcing metals could be subject to more geopolitical considerations, and operational complexity may become increasingly challenging. This is especially the case as producing countries are increasingly imposing export controls or demanding that more processing and value addition take place locally. And rare earth exports in particular can be something of a geopolitical football, such as a Chinese export ban that was issued in October 2025 and suspended just a month later. Expect to see more counterparties, more complex contracts, more red tape, and increasing operational risk from logistics.

Each of these challenges exposes metals traders to more uncertainty and risks; credit and counterparty, market, and operational risks are all going to be increasingly significant in the coming years. And more complexity creates more data to manage and analyse – further increasing operational risk.

The data challenge is further compounded by the traceability, carbon, and ESG data that is increasingly table-stakes for anyone looking to trade global commodities.

The time to digitalise is now

Many metals traders we speak to are already struggling to fully operationalise and digitalise their data right now. Trading firms need the systems and processes to manage all their data in one place if they are to truly get a handle on their operations, make smart data-driven decisions, and mitigate risks effectively.

With an increasing data burden on the horizon, traders whose operations are already struggling to make sense of the data are only going to face compounding problems in the coming years if supply chain complexity increases. Adding more data to an already inefficient system will make any issues worse, meaning more time spent copying information between systems, more spreadsheets working around system data limitations, more human errors, and more confusion.

Adding more data into the mix without a joined-up system for sharing data between teams also increases the risk of building data silos, where information is only available to one team and therefore not providing useful insights across the business. Or, possibly worse, other teams may have access to older or incomplete versions of the information in the silo and are therefore taking actions based on an outdated or incorrect view.

As companies need to manage increasing amounts of data, simply dedicating more man-hours to manual processes becomes less and less practical. It takes experts away from the parts of their role that contribute to the bottom-line, and can mean that no one has a clear understanding of exactly what data the organisation is collecting or how it is processed – making it impossible to access its full value.

A joined-up process for managing data in a digital system is therefore essential. And this system needs to be both flexible and scalable to ensure your organisation can respond as more data challenges inevitably arise.

And it’s not all downsides and risk. Digitalising now means that your organisation is in the best position to take advantage of new technologies and opportunities. AI is one area where organisations with the best data processes are emerging as market leaders. AI tools are only as good as the data that they have, so it is essential for any AI projects to start with an understanding of the data the tools will be using and ensuring that this data remains accurate, relevant and reliable.

Create a complete Commodity Management ecosystem

A good Commodity Management System for metals traders, like Gen10’s CommOS, is designed to help your organisation transform your operations through digitalisation and order your data so that all teams have access to it. CommOS is both flexible and scalable, enabling you to automate your current workflows from counterparty management and deal capture, through to logistics, financial risk, and ESG. And with the ability to add new tools such as AI as they arise, and the ability to incorporate new data sources as your business, and the demands upon it, evolve.

Metals traders need to get their data in order if they are to successfully navigate the challenges the energy transition is likely to throw at us, and to seize the opportunities that are being created. A Commodity Management System allows you to manage and streamline your data, incorporating any number of data sources and distributing information wherever it is needed across your business in real time.

Commodity Management Systems also provide vital tools in helping metals traders manage a wide range of risks. As well as the financial risk management tools you would expect from a CTRM, CommOS allows you to manage all your shipping and logistics, including processing charges and invoicing. With your entire business in one connected system, your teams have access to all the information they need whenever they need it, with no waiting for end-of-day or month-end reports.

And the joined-up platform includes two-way connectivity with other systems to ensure your people always have the full picture. This allows you to manage new data challenges as they arise, and removes the need for manually copying information between systems, reducing the delays and operational risk of errors that comes from copying between systems or spreadsheets.

CommOS streamlines your trading, logistics, finance and risk, by improving and automating your workflows so that you have complete visibility across trades, positions, and compliance, with the scalability to maintain this control as your operations grow. Compliance and ESG reporting become a straightforward part of the daily workflow as there is no need for traders and operators to update reports. Managing their work within CommOS automatically updates positions, valuations, etc, so that risk reporting updates without the need for any additional action on their part.

Conclusion

The energy transition is likely to increase complexity in metals trading. This can create both challenges and opportunities for traders, but having the right systems in place now, systems that can manage your current operations and data flows, with the flexibility to work with whatever new challenges the energy transition raises, makes it much easier for your organisation to mitigate the risks, rise to the challenges, and take advantage of new opportunities as they arise.

If your current Commodity Management or CTRM system is holding you back, book a demo to see how CommOS can help you futureproof your business.